The weight of student loan debt can feel like a heavy anchor on your financial aspirations. Millions of graduates navigate the post-collegiate world burdened by loans, impacting their ability to save for a home, start a family, or pursue other financial goals. But there’s a potential solution – student loan refinancing.

This comprehensive guide dives into the world of student loan refinancing rates, empowering you to make informed decisions and potentially save a significant amount on your student loan debt. We’ll explore the concept, analyze the factors influencing rates, and equip you with strategies to secure the best possible refinancing rate.

Demystifying Student Loan Refinancing: A Fresh Start?

Student loan refinancing involves replacing your existing federal or private student loans with a new loan from a private lender. This new loan typically comes with a (hopefully) lower interest rate and potentially more favorable repayment terms. By consolidating your existing loans into one, you simplify your repayment process and potentially save thousands of dollars in interest over the life of the loan.

Why Refinancing Rates Matter: The Impact on Your Wallet

The interest rate on your student loan is a crucial factor determining your total repayment cost. A lower interest rate translates to significant savings throughout the loan term. Here’s how refinancing rates can impact your finances:

- Reduced Monthly Payment: A lower refinancing rate can lead to a lower monthly payment, freeing up some cash flow for other financial goals.

- Shorter Repayment Term: You may be able to refinance to a shorter loan term, allowing you to pay off your debt faster and save on overall interest charges.

- Long-Term Savings: Even a small decrease in your interest rate can lead to substantial savings over the extended repayment period of student loans.

Factors Influencing Student Loan Refinancing Rates: The Credit Puzzle

Several factors influence the refinancing rate a lender offers you. Understanding these factors empowers you to improve your creditworthiness and potentially secure a better rate:

- Credit Score: This is a numerical representation of your borrowing and repayment history. A higher credit score generally qualifies you for lower interest rates.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt obligations to your gross monthly income. A lower DTI indicates a stronger ability to manage debt and can lead to more favorable rates.

- Loan Type: Refinancing rates may vary depending on whether you’re refinancing federal, private, or a combination of both loan types.

- Repayment Term: Shorter repayment terms often come with lower interest rates, while longer terms typically have higher rates.

- Lender Competition: Compare rates from multiple lenders to find the best possible deal. Don’t settle for the first offer you receive.

Strategies to Secure a Competitive Refinancing Rate: Optimizing Your Application

Understanding the factors influencing rates empowers you to take action. Here are some strategies to enhance your chances of securing a lower refinancing rate:

- Build and Maintain a Strong Credit Score: Focus on responsible credit management practices like paying bills on time, keeping credit card balances low, and diversifying your credit mix. Aim to improve your credit score before applying for refinancing.

- Reduce Your DTI: Seek ways to reduce your existing debt obligations or increase your income to improve your DTI ratio and present a stronger financial profile to lenders.

- Consider a Co-Signer: If you have a limited credit history or a lower credit score, a co-signer with a strong credit score can significantly improve your chances of qualifying for a lower refinancing rate.

- Compare Rates from Multiple Lenders: Don’t settle for the first offer! Shop around and compare refinancing rates, terms, and fees from various lenders to find the best possible deal. Utilize online comparison tools and reach out to banks, credit unions, and private lenders for quotes.

Fixed vs. Variable Refinancing Rates: Choosing the Right Fit

Refinancing loans come with two primary interest rate options: fixed and variable. Here’s a breakdown to help you choose the right type for your situation:

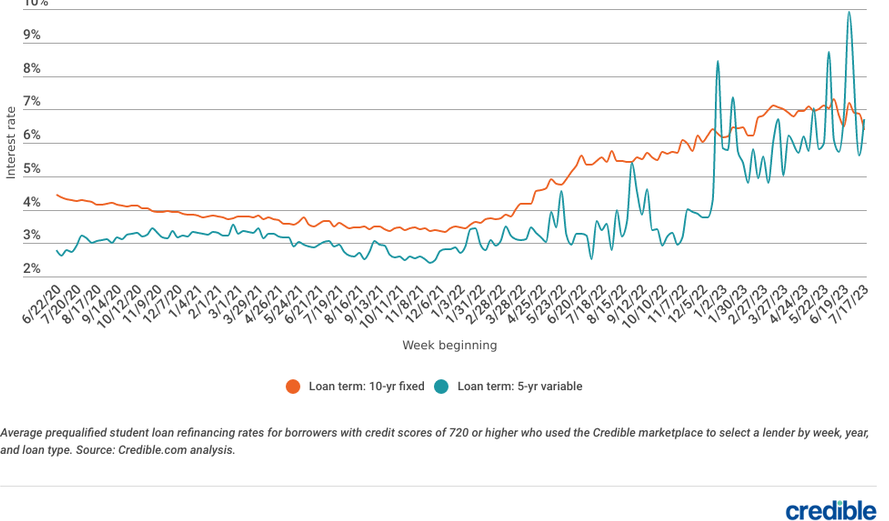

- Fixed Rates: These offer stability and predictability. Your interest rate remains constant throughout the loan term, regardless of market fluctuations. This provides peace of mind and allows for easier budgeting.

- Variable Rates: These can be lower than fixed rates initially, but they fluctuate based on market conditions. While you could potentially benefit from a lower rate if the market dips, there’s also a risk of your interest rate increasing in the future, leading to higher monthly payments.

Weighing the Pros and Cons: Is Refinancing Right for You?

Pros:

- Potentially Lower Interest Rates: This can translate to significant savings over the life of the loan.

- Simplified Repayment: Consolidate multiple loans into one, streamlining your repayment process.

- Flexible Repayment Options: Some lenders offer flexible repayment terms, allowing you to choose a repayment schedule that aligns with your budget and financial goals.

- Potential for Private Loan Benefits: Refinancing private loans can potentially unlock advantages like co-signer release or forbearance options, unavailable with federal loans.

Cons:

- Loss of Federal Loan Benefits: Refinancing federal loans into a private loan means you lose access to income-driven repayment plans, loan forgiveness programs, and federal protections.

- Potential for Higher Rates: If you have a good credit score with federal loans, refinancing may not always guarantee a lower rate.

- Variable Rate Risk: With variable-rate loans, your interest rate and monthly payments could increase in the future, impacting your budget.

Conclusion: Navigating the Refinancing Journey with Confidence

Student loan refinancing can be a powerful tool for managing your debt and potentially saving money. However, it’s crucial to weigh the pros and cons, understand the factors influencing rates, and approach it strategically. Here are some final takeaways:

- Do Your Research: Thoroughly research different lenders, compare rates, and carefully review loan terms and fees before making a decision.

- Consider Your Financial Goals: Align your refinancing strategy with your long-term financial aspirations. Prioritize lower interest rates if saving money is your primary goal. Opt for shorter repayment terms if debt payoff is your priority.

- Seek Guidance if Needed: If you have complex loan situations or require financial advice, consider consulting a credit counselor or financial advisor. They can assist you in evaluating your options and making informed decisions.

By taking control of your student loan debt through informed refinancing strategies, you can free up valuable financial resources and pave the way for a brighter financial future. Remember, knowledge is power. Equip yourself with the information presented here, make calculated decisions, and you can navigate the student loan refinancing journey with confidence.